With the annual enrollment period for Medicare Advantage (MA) plans slated to open in less than two months, many MA plans are cutting benefits and provider payments, while approving fewer claims. Further, after a decade of accelerated growth in the MA market, several MA plan executives have announced MA market exits and decreases in membership for the upcoming plan year.1 This Health Capital Topics article discusses recently announced MA market exits, the reasons for those exits, and the current environment in which MA plans are operating.

MA plans, also known as Part C plans, serve as a supplement or an alternative to Traditional fee-for-service (FFS) Medicare Part A and Part B coverage, but they are still part of the Medicare program.2 MA was created to offer seniors an alternative to Traditional Medicare – with an emphasis on treating and managing the health of the whole patient. MA plans are offered to Medicare beneficiaries by Medicare-approved private companies that must follow rules set by Medicare.3 Under the MA program, Medicare purchases insurance coverage for Medicare beneficiaries from private MA plans. These plans can be advantageous for beneficiaries because they limit patient out-of-pocket costs for covered services (although out-of-pocket costs vary by plan) and may cover additional healthcare services (e.g., fitness programs, vision, dental, hearing) as well as other benefits (e.g., transportation to appointments, drugs/services that promote wellness).4 However, in order to manage costs, MA organizations may require beneficiaries to utilize providers in the plan’s network.

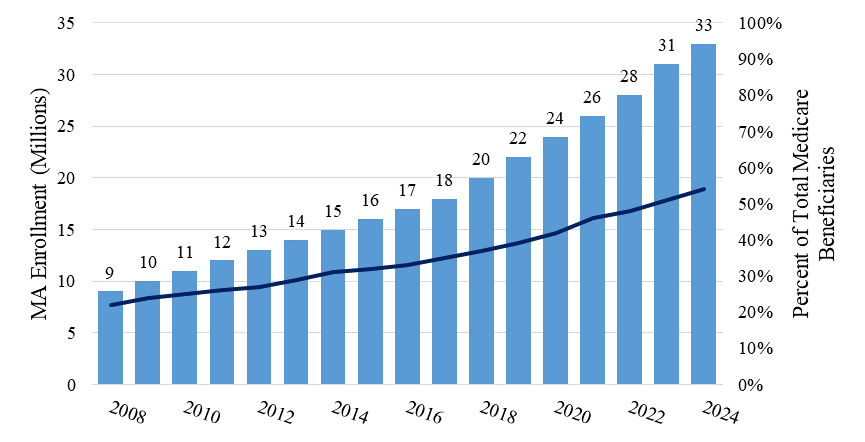

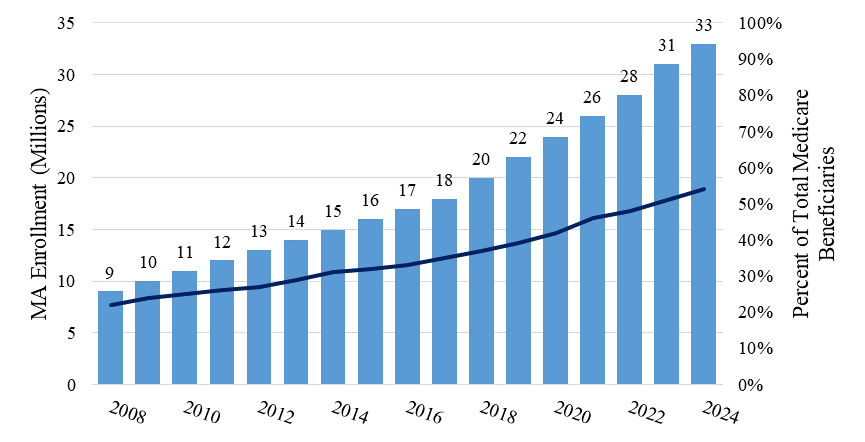

As illustrated in Exhibit 1 below, enrollment in MA plans has grown much faster than in Traditional Medicare. As of 2024, 32.8 million Americans are enrolled in an MA plan,5 comprising 54% of total Medicare enrollment, which proportion is expected to increase to 64% by 2033.6

Exhibit 1: Medicare Advantage Enrollment, 2008-20247

While nearly all Medicare beneficiaries have access to an MA plan,8 MA enrollment is not well-distributed geographically, with the percent of Medicare beneficiaries enrolled in MA highest in the Eastern U.S.

Exhibit 2: Medicare Advantage Penetration by County, 20249

Due to the growing popularity of MA plans, and the number of Americans becoming Medicare eligible every year, MA enrollment has steadily increased over the past two decades.10 However, over the past year, there has been speculation as to whether the MA “gold rush” has reached its apex.11 UnitedHealth (the largest MA plan in the U.S.) forecasted its 2024 enrollment to slow from 11% growth to approximately 5%.12 Further, Aetna, Centene, and Humana have all announced MA market exits and/or membership declines for the upcoming enrollment year, and many plans have threatened to reduce benefits, tighten prior authorization policies, and reassess provider networks and markets.13 For the 2024 enrollment year, twelve MA plans exited the MA market, replaced by only three new entrants.14 In September 2024, Humana announced that it would exit 13 counties where its performance has been substandard, resulting in an expected loss of hundreds of thousands of members; Humana also announced it would reduce certain benefits and increase premiums.15 Additionally, Cigna announced that it would fully exit at least three counties in 2025 and reduce service areas in eight states (Colorado, Florida, Illinois, Missouri, North Carolina, Tennessee, Texas and Utah), affecting over 5,300 beneficiaries.16 A month prior, Centene announced the upcoming exit of its WellCare MA subsidiary from MA markets in six states (Alabama, Massachusetts, New Hampshire, New Mexico, Rhode Island and Vermont), affecting approximately 37,300 members (3% of Centene’s total MA enrollment).17 In June 2024, Blue Cross and Blue Shield of Kansas City, a relatively small MA plan, announced it would exit the MA market entirely by the end of 2024, due to “heightened regulatory demands and rising market and financial pressures.”18

The reasons for the seemingly abrupt turn in MA expectations stem from a number of reimbursement and regulatory changes over the past year. In April 2024, the Centers for Medicare & Medicaid Services (CMS) announced a 0.16% reduction in the MA benchmark rate, the second consecutive year of rate cuts.19 Moreover, MA plans will receive approximately 8% less in Medicare bonuses in 2024 compared to the prior year (the first decrease since before 2015).20 Compounding this problem, MA plan expenditures have risen, due largely to increased member utilization post-pandemic.21 In addition, the government has increased its scrutiny over MA prior authorization, marketing, and brokers, and made changes to the Star Ratings quality program, making high scores – and resulting bonus payments – more difficult to obtain.22 Aside from reimbursement and regulatory pressures, competition among MA plans has increased, with a more than 100% increase in the number of offered MA plans between 2018 and 2023, as commercial insurers seek to “tap into a rapidly expanding market segment.”23

For the most part, MA plans are no longer able to counter the risk presented by these various stressors with surges in enrollment (and, consequently, profitability), as the last of the Baby Boomers will age into Medicare in 2030, capping a significant influx of Americans into the age 65+ cohort over the past two decades. Going forward, the Congressional Budget Office (CBO) predicts MA plan enrollment growth of 1% per year, the lowest rate in ten-plus years.24 MA plans are therefore attempting to turn the tide on their profitability by not just reducing their geographic footprints and reducing their beneficiary offerings, as discussed above, but also by squeezing hospitals through increased claim denials and additional prior authorization policies, negatively affecting both hospitals and patients.25 In return, hospitals are increasingly disputing MA plan coverage determinations, or altogether opting out of MA plan in-network agreements.26 This could commence a vicious circle between hospitals and MA plans in which everyone – most importantly patients – loses.

Despite the various headwinds faced by MA plans, they are anticipated to still be the most profitable payor business segment in 2026.27 However, previously bullish analyses on the future of MA may be overstated. In order to right-size, MA plans seem to be getting back to basics in order to weather the storm of increased costs and utilization combined with decelerating enrollment.

“Will 2025 Mark a Turning Point for Medicare Advantage?” By Laura Beerman, HealthLeaders, September 4, 2024, https://www.healthleadersmedia.com/payer/will-2025-mark-turning-point-medicare-advantage (Accessed 9/6/24).

“Your health plan options” Medicare.gov, https://www.medicare.gov/health-drug-plans/health-plans/your-health-plan-options (Accessed 9/6/24).

“Medicare Advantage in 2024: Enrollment Update and Key Trends” By Meredith Freed, et al., Kaiser Family Foundation, August 8, 2024, https://www.kff.org/medicare/issue-brief/medicare-advantage-in-2024-enrollment-update-and-key-trends/ (Accessed 9/6/24).

Beerman, HealthLeaders, September 4, 2024.

Freed, et al., Kaiser Family Foundation, August 8, 2024.

“The Medicare Gold Rush Is Slowing Down” By David Wainer, The Wall Street Journal, December 6, 2023, https://www.wsj.com/health/healthcare/the-medicare-gold-rush-is-slowing-down-ebc5a4af (Accessed 9/6/24).

Beerman, HealthLeaders, September 4, 2024; “Humana, Aetna likely to lose Medicare Advantage members” By Nona Tepper and Lauren Berryman, Modern Healthcare, May 14, 2024, https://www.modernhealthcare.com/insurance/aetna-humana-expect-medicare-advantage-membership-losses-2025 (Accessed 9/6/24).

Freed, et al., Kaiser Family Foundation, November 15, 2023.

“Humana to depart 13 Medicare Advantage markets” By Lauren Berryman, Modern Healthcare, September 4, 2024, https://www.modernhealthcare.com/insurance/humana-medicare-advantage-markets-2025 (Accessed 9/6/24).

“Cigna to cut Medicare Advantage plans in several states” By Lauren Berryman, Modern Healthcare, September 19, 2024, https://www.modernhealthcare.com/insurance/cigna-medicare-advantage-plans-2025 (Accessed 9/20/24).

“Centene Medicare Advantage subsidiary WellCare to retreat from 6 states in 2025” By Noah Tong, FierceHealthcare, August 7, 2024, https://www.fiercehealthcare.com/payers/centene-subsidiary-wellcare-retreats-six-states-2025 (Accessed 9/6/24).

“Blue KC exiting Medicare Advantage market by 2025 due to 'regulatory demands'” By Noah Tong, FierceHealthcare, June 3, 2024, https://www.fiercehealthcare.com/payers/blue-kc-exiting-medicare-advantage-market-2025-due-regulatory-demands (Accessed 9/6/24).

“CMS finalizes Medicare Advantage rate cut” By Lauren Berryman and Nona Tepper, Modern Healthcare, April 1, 2024, https://www.modernhealthcare.com/policy/medicare-advantage-rate-cut-cms-2025 (Accessed 9/6/24).

“Kaiser, Humana, UnitedHealth reap big Medicare Advantage bonuses” By Lauren Berryman, Modern Healthcare, September 12, 2024, https://www.modernhealthcare.com/insurance/kaiser-humana-unitedhealth-medicare-advantage-star-bonuses-cms (Accessed 9/13/24).

“Rising Medicare Advantage costs squeeze providers, insurers, tech” By Nona Tepper, Modern Healthcare, February 1, 2024, https://www.modernhealthcare.com/medicare/medicare-advantage-costs-humana-aetna-cano-health-caremax (Accessed 9/6/24); Beerman, HealthLeaders, September 4, 2024.

“Medicare Advantage provider, benefit cuts may follow rate reduction” By Nona Tepper, Modern Healthcare, February 6, 2024, https://www.modernhealthcare.com/insurance/medicare-advantage-rate-cut-2025-reimbursements-benefits-unitedhealth-humana (Accessed 9/6/24).

“How do Medicare Advantage plans compete in a crowded market?” By Nate Jacoby, et al., PWC, September 25, 2023, https://www.pwc.com/us/en/industries/health-industries/library/how-medicare-advantage-plans-compete.html (Accessed 9/11/24).

Beerman, HealthLeaders, September 4, 2024.

“Why Medicare Advantage plans are losing more providers” By Alex Kacik, Modern Healthcare, September 10, 2024, https://www.modernhealthcare.com/providers/medicare-advantage-plans-provider-insurer-contracts-humana-unitedhealthcare (Accessed 9/11/24).

“Sweeping changes to Medicare Advantage: How payers could respond” By Gabe Isaacson, et al., McKinsey, July 11, 2023, https://www.mckinsey.com/industries/healthcare/our-insights/the-future-of-medicare-advantage (Accessed 9/6/24).