Commercial Reasonableness Opinions

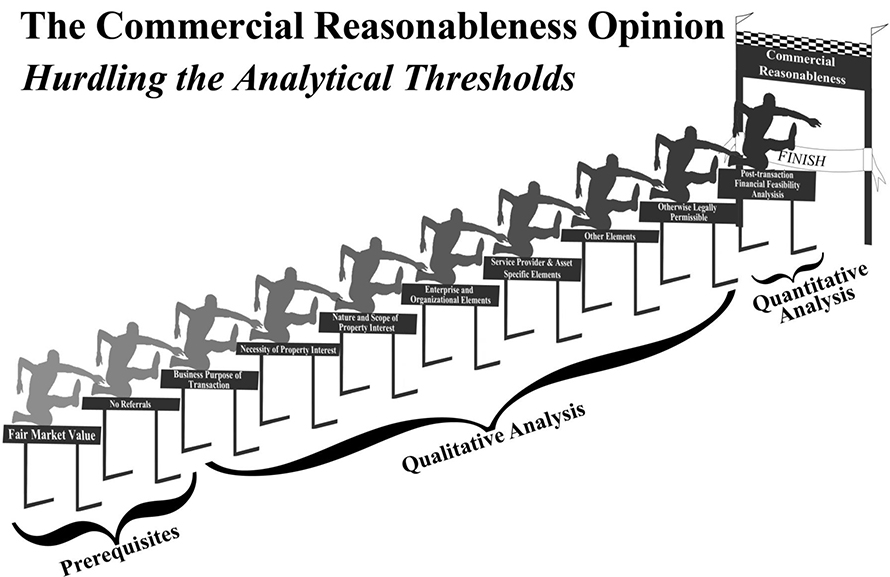

Due to the heightened legal and regulatory scrutiny of healthcare related transactions, the issuance of Commercial Reasonableness opinions is a growing area of focus for professional advisors and consultants in the healthcare industry. Note that, the threshold of Commercial Reasonableness is separate and distinct from the threshold of Fair Market Value, and the consideration and analysis of one threshold does not preclude the analysis of the other threshold. For example, a necessary condition in order for an anticipated transaction to be Commercially Reasonable is that each element of the transaction must not exceed Fair Market Value. However, even in the event that each element of an anticipated transaction does not exceed Fair Market Value, the transaction may still be deemed not to be Commercially Reasonable, in that it does not meet the remaining qualitative and quantitative hurdles.

Commercial Reasonableness opinions are informed by the evolving guidance derived from healthcare related statutes, rules, and regulatory pronouncements, as well as some minimal indications, to date, from pertinent case law.

Commercial Reasonableness Defined

CMS has historically interpreted the term “commercially reasonable” to mean that an arrangement appears to be:

“a sensible, prudent business agreement, from the perspective of the particular parties involved, even in the absence of any potential referrals.”1

CMS finally established a formal definition for Commercial Reasonableness in its December 2020 Final Rule. Effective January 19, 2021, Commercial Reasonableness, in the context of the Stark Law, means:

“that the particular arrangement furthers a legitimate business purpose of the parties to the arrangement and is sensible, considering the characteristics of the parties, including their size, type, scope, and specialty. An arrangement may be commercially reasonable even if it does not result in profit for one or more of the parties.”2

Notably, “[a]n arrangement may be commercially reasonable even if it does not result in profit for one or more of the parties.”3

The IRS regulations equate reasonable compensation to the value of services provided, and defines reasonable compensation as: “the amount that would ordinarily be paid for like services by like enterprises (whether taxable or tax-exempt) under like circumstances.”4 Items included in determining the value of compensation for purposes of determining reasonableness under Section 53.4958 are:

- “all forms of cash and noncash compensation, including salary, fees, bonuses, severance payments and deferred and noncash compensation;”5

- “payment of liability insurance premiums;”6 and,

- “all other compensatory benefits, whether or not included in gross income for tax purposes, including payments to welfare benefit plans, such as plans providing medical, dental, life insurance, severance pay, and disability benefits.”7

Because CMS’s definition of Commercial Reasonableness is so novel (and thus the term has yet to be interpreted by case law, enforcement agencies, or additional regulatory guidance, Health Capital Consultants (HCC) has formulated a disciplined and robust process that assesses both the qualitative and the quantitative elements of a transaction in assessing its Commercial Reasonableness, which includes past indications related to the term from the Internal Revenue Code (IRC), Treasury Regulations, other IRS publications and pronouncements related to reasonable compensation; OIG Advisory Opinions and pronouncements; Anti-Kickback Regulations; the U.S. Public Health Code; and, pertinent case law.

Qualitative Assessment

The qualitative assessment related to the commercial reasonableness of an integration transaction includes deriving answers to the following:

- Is the transaction a sensible, prudent business agreement even in the absence of referrals;

- Is the integration transaction necessary to accomplish the business purpose of the client;

- Does the nature and scope of the underlying elements of the integration transaction meet the business needs of the client;

- Does the enterprise and organizational elements of the integration transaction make business sense to the client;

- Does the quality, comparability, and availability of the underlying elements of the integration transaction make business sense for the client; and,

- Are there sufficient ongoing assessments, management controls, and other compliance measures in place related to the underlying elements of the integration transaction.

Quantitative Assessment

In assessing the Commercial Reasonableness of an integration transaction from a quantitative perspective, which is commonly referred to as a post-transaction financial feasibility analysis, the following analytical techniques may be used:

- Payback Period or Discounted Payback Period Analysis;

- Net Present Value Analysis; or,

- Internal Rate of Return.

- “Medicare and Medicaid Programs; Physicians’ Referrals to Health Care Entities With Which They Have Financial Relationships” Fed. Reg. Vol. 63, No. 6, (Jan. 9, 1998), p.1700.

- “Definitions” 42 C.F.R. § 411.351.

- “Definitions” 42 C.F.R. § 411.351.

- Treasury Reg. Section 53.4958-4(b)(ii)(A).

- Treasury Reg. Section 53.4958-4(b)(ii)(B)(1).

- Treasury Reg. Section 53.4958-4(b)(ii)(B)(2).

- Treasury Reg. Section 53.4958-4(b)(ii)(B)(3).